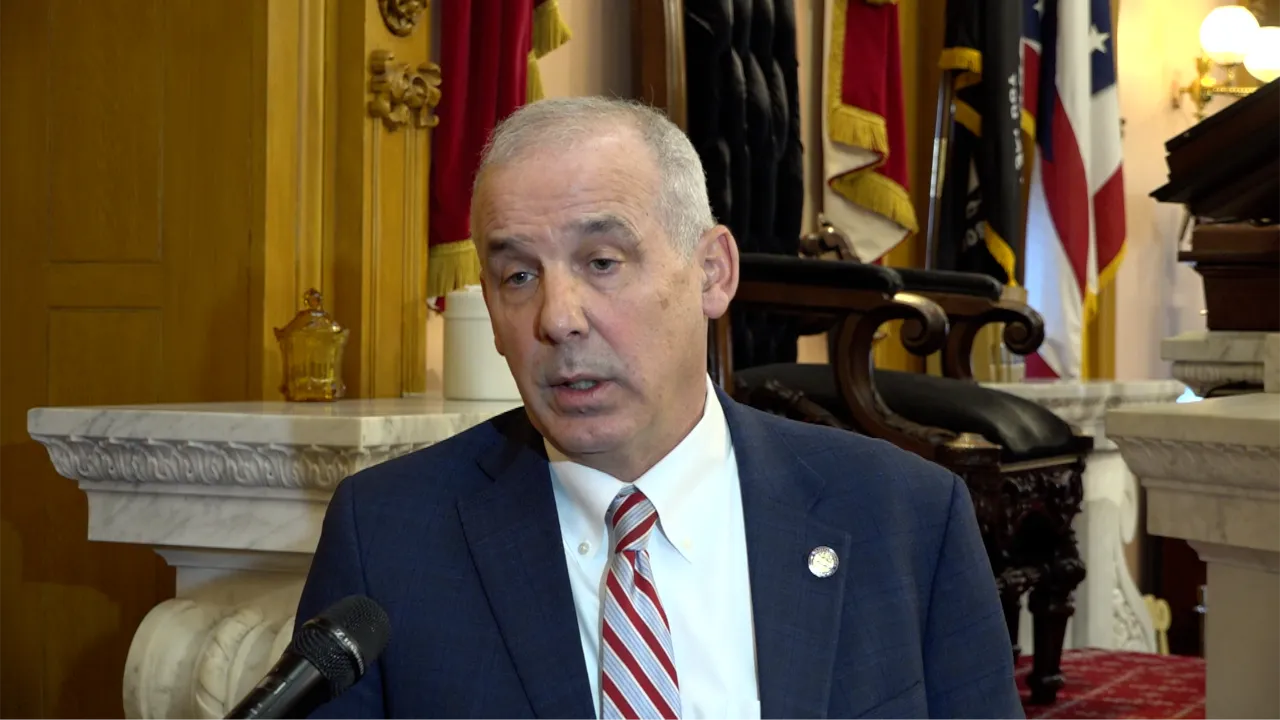

In the heart of America, a political storm is brewing that could shift the balance between local government, school districts, and taxpayers. Ohio House Speaker Matt Huffman has challenged Governor Mike DeWine by announcing his intention to veto three of the governor’s objections to property tax reform. The vote scheduled for July 21 has become the culmination of a tense standoff revealing deep divides over approaches to addressing the rapid increase in taxes burdening Ohio property owners.

Clash over control of taxes

At the center of the conflict is DeWine’s veto of provisions that would grant county budget commissions the authority to overturn voter-approved taxes, change assessment methods for school districts, and limit the types of taxes that these districts can put to a vote. The governor also blocked a proposal that would limit the amount of reserve funds school districts can carry over from year to year, but legislators decided to focus on only three of the four vetoes for removal.

At a press conference, DeWine warned that these changes could cause a “huge problem” for local schools, citing the risk of financial instability. He proposed creating a new working group to develop recommendations on tax reform, but this idea faced sharp criticism. “We don’t need another working group. We need action,” said Texas Fisher, a Republican from Boardman, via social media, expressing frustration shared by many colleagues who see the governor’s proposal as a delay.

Political divide and accusations

Republicans controlling Ohio’s General Assembly have come under fire for the inconsistency of their stance. Last year, they supported funding for a new NFL stadium and tax cuts for the wealthiest residents, which Democrats say undermines their claims of fighting the tax burden. Minority Leader Daniel Isaacson accused Republicans of a “farcical game.” “Governor DeWine recognized this tactic and vetoed measures to protect our schools and local governments,” he said, calling for bipartisan solutions that would bring real change.

Meanwhile, Fisher and Representative Beth Lier, a Republican from Delaware, are preparing a bill that would impose stricter restrictions on property taxes. Their initiative reflects growing taxpayer dissatisfaction with rising payments amid escalating property values.

The tax system labyrinth

The property tax system in Ohio is a complex mechanism enshrined in the state constitution. Jurisdictions can levy up to 10 mills (1% of property value) without voter approval, but any excess requires a vote. In the 1970s, to curb the growth of taxes due to inflation in property values, lawmakers introduced an adjustment coefficient that reduces rates but not below 20 mills for school districts.

However, school districts found a workaround through certain assessments not subject to this coefficient. The state budget proposed including these assessments in the minimum 20-mill floor, allowing some districts to further lower rates. DeWine vetoed this change, arguing it limits the financial flexibility of school districts.

Voices beyond the Capitol

Tom Zaino, former state tax commissioner and head of the Ohio Taxpayers’ Defense Coalition, insists that the reforms aim to curb inflation-driven tax increases, not to reduce school revenues. “We’re not taking their money. They can ask voters for additional funds,” he said. His coalition, supported by the Ohio Chamber of Commerce and the Realtors Association, calls for abolishing all four of the governor’s vetoes.

Donovan O’Neill from Americans for Prosperity Ohio described the legislators’ initiative as “a taxpayer-friendly stance,” emphasizing that reforms return control to voters. However, Scott DiMauro, president of the Ohio Education Association, considers these efforts misguided. “Lawmakers underfund schools and try to solve the tax issue at the expense of students,” he stated, urging rejection of the veto override attempt.

Decisive battle ahead

The vote on July 21 will be a turning point for Ohio. Success in overriding the veto could alter the rules for funding local communities and schools, but it also risks deepening the political divide. In a state where property taxes remain a persistent source of tension, the outcome of this confrontation will have far-reaching consequences for taxpayers, education, and Ohio’s political landscape.